12 Popular AI Bots for Trading Crypto

You check the markets at dawn and again at night, yet a single missed signal can erase hours of careful work; balancing analysis, timing, and risk feels like a second job. What is AI Trading? It answers that problem by using algorithmic trading, machine learning, and automated trading bots to scan markets, generate trading signals, and execute strategies without constant oversight. This article cuts through options and jargon to show you Popular AI Bots for Trading Crypto, how prediction models, backtesting, and risk management shape performance, and which automated strategies might match your goals.

To help with that, Coincidence AI’s AI crypto trading bot gives you a simple way to test strategies, follow signals, and see how automation handles trades and risk in real time.

Summary

- Speed changes what strategies are feasible. AI trading bots can process data up to 1,000 times faster than a human trader, so ingesting news, sentiment, and microstructure signals quickly is essential before an edge is lost.

- Execution quality often determines whether a predictive signal turns into real PnL, CoinMarketCap reports AI bots accounted for 60% of crypto trading volume in 2025, which makes slippage, smart order routing, and liquidity-aware sizing decisive.

- Automated safeguards materially reduce mistakes. SoftCircles found that AI-driven trading systems lowered trading errors by 30% compared to manual trading, thanks to sanity checks, simulated fills, and rollback gates.

- Reported practitioner outcomes appear promising, but are conditional. CapTrader data shows 85% of crypto traders using AI bots reported increased profitability in 2025, provided sizing, liquidity assumptions, and governance are properly handled.

- AI shifts competitive advantage to operational rigor. A16z reports AI-driven trading algorithms increased trading efficiency by 35% in the past year, highlighting the need for versioning, drift surveillance, and realistic execution assumptions.

- Adoption gains mask practical constraints for small accounts. Coincub notes AI trading bots can execute trades 100 times faster than human traders, yet fees, slippage, and margin costs can still erase returns unless sizing and latency are controlled.

- This is where Coincidence AI's AI crypto trading bot fits in, addressing execution, sizing, and governance gaps by converting plain-English strategy intent into exchange-connected bots with shadow execution and built-in risk controls.

What Are AI Trading Bots?

AI trading bots are software that use machine learning to convert streams of market data into automated trade decisions and order execution, operating continuously without human intervention in each trade. They replace manual timing with rule-driven, adaptive systems that test, learn from outcomes, and iterate on strategy in real time.

How Do They Learn What to Do?

AI bots utilize a combination of supervised models, neural networks, reinforcement learning, and natural language processing to extract signals from price, order book, and text data. Models generate candidate trades, backtest score them, and execution logic manages sizing, slippage, and stop rules. Think of the stack as three layers:

- Signal discovery

- Risk-aware sizing

- Low-latency execution

Each of which must be tuned, or the whole system underperforms.

Why Does Speed Matter So Much?

Speed changes what strategies are feasible. AI trading bots can process data up to 1000 times faster than a human trader. The Medium analysis from 2025 frames this as a raw execution advantage, because the quicker you can ingest news, sentiment, and microstructure signals, the more reliably you can act before an edge is lost.

What Breaks for Traders Trying This on Their Own?

This challenge is prevalent among retail traders and small prop desks, as AI systems often require substantial capital to cover fees, slippage, and margin, eroding the returns of small accounts. It is exhausting when a bot signals a perfect entry but execution lags, or when strategies tuned on historical data fail in a sudden liquidity drain. I see the failure mode clearly:

- Good models become irrelevant without proper sizing

- Latency control

- Risk limits

Automation Fragmentation & Risk

Most teams handle strategy automation with alert chains and manual execution because it feels low-friction and requires no coding. As activity scales, those chains fragment: rules reside in spreadsheets, alert bots inundate you with noise, and risk controls are inconsistent across exchanges, which creates unseen losses and overnight exposure.

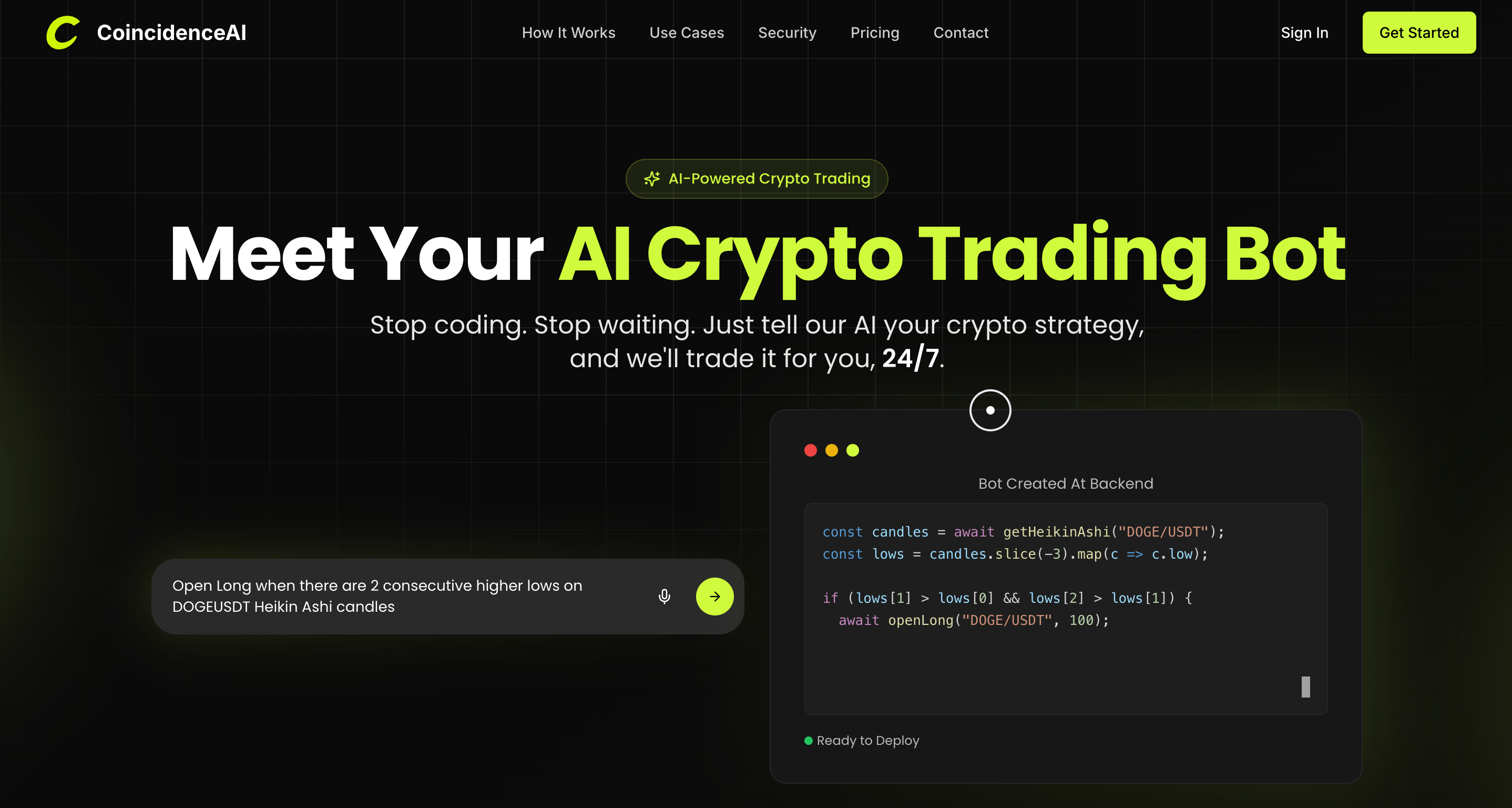

Plain-English Algorithmic Trading

Platforms such as CoincidenceAI offer a different path, allowing traders to connect, converse, and deploy strategies in plain English, with official OAuth/API links and exchange-side custody, ensuring funds never leave the exchange. This yields continuous 24/7 execution and baked-in risk controls that keep strategy intent aligned with live orders.

How Does Market Structure Shape What Works?

Over 70% of all trading volume in the U.S. stock markets is generated by algorithmic trading. The 2025 Medium piece utilizes this concept to illustrate how algorithmic dominance compresses opportunities: edges shrink, and competitive edges become a function of data hygiene, execution quality, and how quickly models adapt to regime shifts, rather than clever heuristics alone.

When Should You Use Bots, and When Should You Hold Back?

Bots excel where repetitive execution, fast signal integration, and strict risk rules matter, like:

- Market-making

- Trend-following

- Monitoring social triggers for size-scaled entries

They fail when applied to low-liquidity memecoins without trust filters, or when traders automate ethically dubious alerting tactics that amplify scams.

Automation as an Operational Tool

The right approach is pragmatic: limit position sizes, set clear stop rules, and treat automation as an operational tool that requires ongoing tuning, not a turn-key profit machine. A short, concrete comparison: bots are like autopilots on a plane; they keep the aircraft steady and follow the flight plan, but the pilot still chooses the destination, watches the instruments, and overrides when weather changes.

That still leaves a question about how these systems actually behave in crypto markets, and why their mechanics make all the difference.

How AI Bots Work in Crypto Markets

AI bots convert live signals into orders by running a tight production pipeline: ingest, feature transform, score, decide, and execute, all with continuous checks to prevent bad ideas from becoming bad trades. They do more than predict price direction; they manage impact, adapt models on the fly, and enforce risk rules so a single model failure cannot cascade into a blown account.

How Do Teams Keep Models Honest in Flight?

When we deploy models, the focus shifts from accuracy to surveillance, encompassing walk-forward validation, shadow execution, and real-time performance drift metrics. Rigorous post-deployment monitoring explains why SoftCircles' 2023 finding that AI-driven trading systems have reduced trading errors by 30% compared to manual trading matters, because those reductions come from automated sanity checks, simulated fills, and rollback gates that stop anomalous orders before they execute.

Where Does Execution Actually Win or Lose Money?

Execution quality is the differentiator. With CoinMarketCap reporting that AI bots account for 60% of trading volume in crypto markets in 2025, liquidity becomes a contested resource, and slippage, fee schedules, and microstructure play a larger role than raw predictive signal. Intelligent order routing, dynamic order slicing, and liquidity-aware sizing turn a statistical edge into realized gains, while naive market orders turn edges into losses.

Scaling Risk and Error

Most teams handle strategy rollout the old way, by copying rules into spreadsheets and hand-launching orders, because it feels safe and familiar. That works at first, but as strategies multiply and markets move quickly, the hidden cost becomes apparent: inconsistent risk settings, missed deployment windows, and manual errors that compound overnight.

Aligning Intent and Execution

Platforms like CoincidenceAI offer a different approach; teams discover that they can convert plain-English strategy ideas into live, exchange-connected bots using official OAuth/API links, keep funds on the exchange, and deploy consistent risk controls, ensuring intent and execution remain aligned as activity scales.

How Do Bots Survive Regime Shifts and Noisy Signals?

This is a typical pattern among retail and semi-professional traders: volatility leads to emotional exits, and long-term plans lose coherence. Sound systems layer a regime detector on top of ensemble models, gating aggressive strategies during stress and switching to conservative sizing when liquidity thins.

Online learning and scheduled retraining handle slow drifts, while hard-coded fallbacks and human-in-the-loop approvals catch the fast, unexpected moves. Think of it like a thermostat that learns the house, rather than a timer that simply turns the heater on and off.

What Does Responsible Deployment Look Like in Practice?

Responsible bots come with governance baked in: position limits by asset and account, portfolio-level stop logic, automated margin checks, anomaly detectors, and immutable audit logs for every decision. Secure API connections, granular permission scopes, and revocable keys reduce operational risk, while paper trading and shadow fills provide users with confidence before any real capital is at risk.

That solution feels complete until you see the choices between different bot architectures and how they behave in the wild.

Related Reading

- What is AI Trading

- Why Is Bitcoin Going Down

- Day Trading Crypto

- Where to Buy Meme Coins

- Is Bitcoin Going to Crash

- Is XRP the Next Bitcoin

- What Is AI Arbitrage

12 Popular AI Bots for Crypto Trading

1. CoincidenceAI

CoincidenceAI transforms plain-English trading ideas into live bots, enabling you to connect exchanges, describe a rule in natural language, and deploy automated execution without coding.

Who It fits

Traders who value speed of iteration and want automation that reads like a conversation, not a codebase.

Distinct Strengths

Instant backtesting against historical data, OAuth exchange links that keep keys managed by the exchange, and a focus on consistent risk controls to keep strategy intent aligned with orders.

Tradeoffs and Notes

Because it abstracts logic into language, complex microstructure still requires review; users should validate sizing and slippage in paper mode before full deployment.

2. ByBit

ByBit combines an exchange with AI features, including TradeGPT for market chat and the Aurora AI suite, which automates strategy components within its ecosystem.

Who It Fits

Active traders already using ByBit for liquidity and margin, who want built-in signal assistance and automation without chaining external tools.

Distinct Strengths

Deep native liquidity for derivatives, integrated leverage tools, and mobile-first execution.

Tradeoffs and Notes

Using exchange-native AI trades, convenience is traded for portability; strategies tied to one exchange will need to be reworked to move elsewhere.

3. WunderTrading

WunderTrading is a cloud platform that links to multiple exchanges and offers strategy bots, arbitrage detection, and copy trading.

Who It Fits

Traders who want a single control plane for multiple exchange accounts and the ability to mirror experienced traders.

Distinct Strengths

Cross-exchange arbitrage bots, a trading terminal for manual intervention, and copy trading that exposes novice users to battle-tested rules.

Tradeoffs and Notes

Cross-exchange setups increase withdrawal and transfer timing risks; therefore, it is crucial to closely monitor balances and settlement latency.

4. Kryll

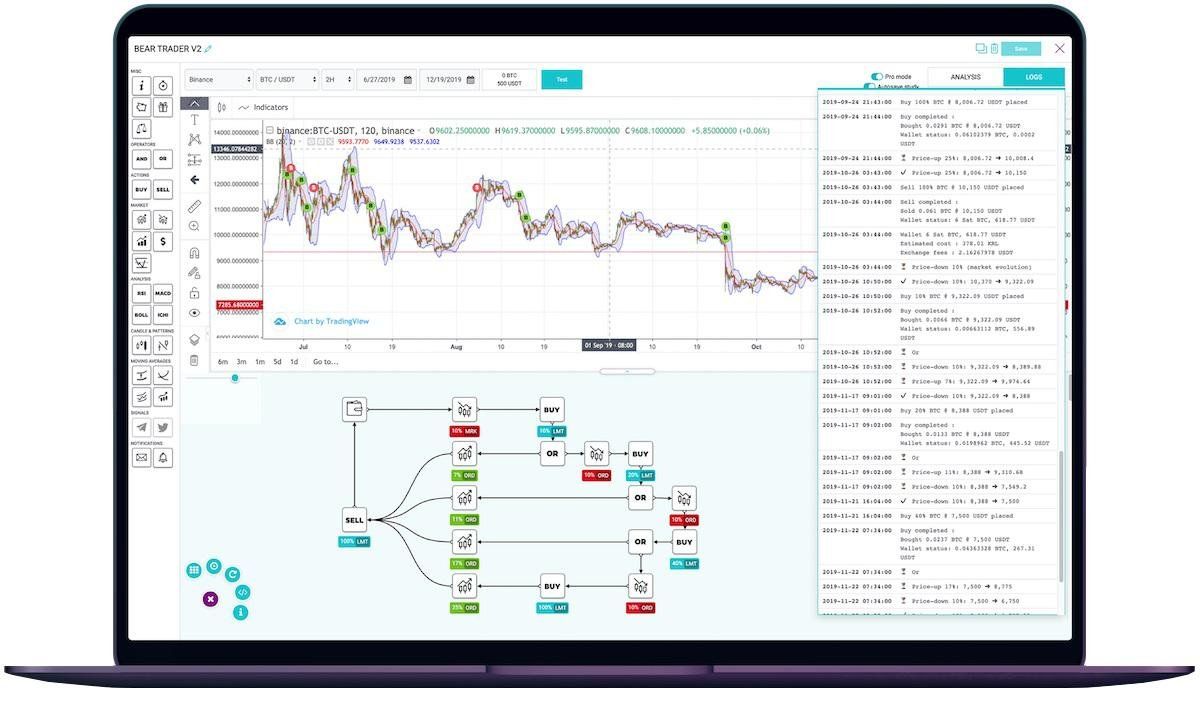

Kryll provides a drag-and-drop visual strategy builder and an AI SmartFolio engine that manages assets across chains.

Who It Fits

Users who prefer visual design over scripting and those interested in on-chain portfolio adjustments.

Distinct Strengths

Visual workflow for strategy logic and portfolio-level AI that rebalances across multiple chains.

Tradeoffs and Notes

Visual builders speed prototyping, but they can obscure execution subtleties like order slicing and market impact; always examine execution logs.

5. 3Commas

3Commas offers a comprehensive suite of bots, ranging from DCA to Grid to Signal-driven automation, as well as portfolio and paper trading tools.

Who It Fits

Traders who want mature bot templates plus marketplace signals to combine with their own sizing rules.

Distinct Strengths

A robust marketplace ecosystem, paper trading, and seamless integrations with major exchanges.

Tradeoffs and Notes

Template-driven automation is fast to launch; however, overreliance on marketplace signals without proper sizing discipline can magnify losses.

6. Cryptohopper

Cryptohopper offers a strategy designer featuring over 130 indicators, marketplace signals, and AI-driven backtesting, which enables the evaluation of multiple strategies in parallel.

Who It Fits

Traders who want to iterate quickly across indicator combinations and deploy hybrid automated or manual workflows.

Distinct Strengths

Massive indicator set, automated strategy switching, and simulator trading for low-risk practice.

Tradeoffs and Notes

The platform’s flexibility demands governance; run shadow executions before turning strategies live to detect unexpected interactions.

Human Process Failure Under Load

Most teams handle bot rollout by cobbling together alerts, spreadsheets, and manual approvals because this method feels low-friction and requires no new tools. That familiar approach works until rules multiply, approvals slow, and subtle misconfigurations lead to overnight exposure, because human processes break down under scale.

Teams find that platforms like CoincidenceAI replace fragmented routing with conversational strategy capture and exchange-connected deployment, compressing rollout time while preserving audit trails and security.

7. Composer

The composer converts natural language goals into programmatic trading algorithms and offers a no-code visual editor for editing.

Who It Fits

Users who want a middle ground between entirely visual builders and raw scripting, and who want to experiment without subscription friction.

Distinct Strengths

Free tier availability, 0.2 percent trade fee on crypto trading mode, and editable pre-built strategies for quick starts.

Tradeoffs and Notes

Fee-per-trade models favor moderate-frequency strategies; high-frequency experiments can become prohibitively costly.

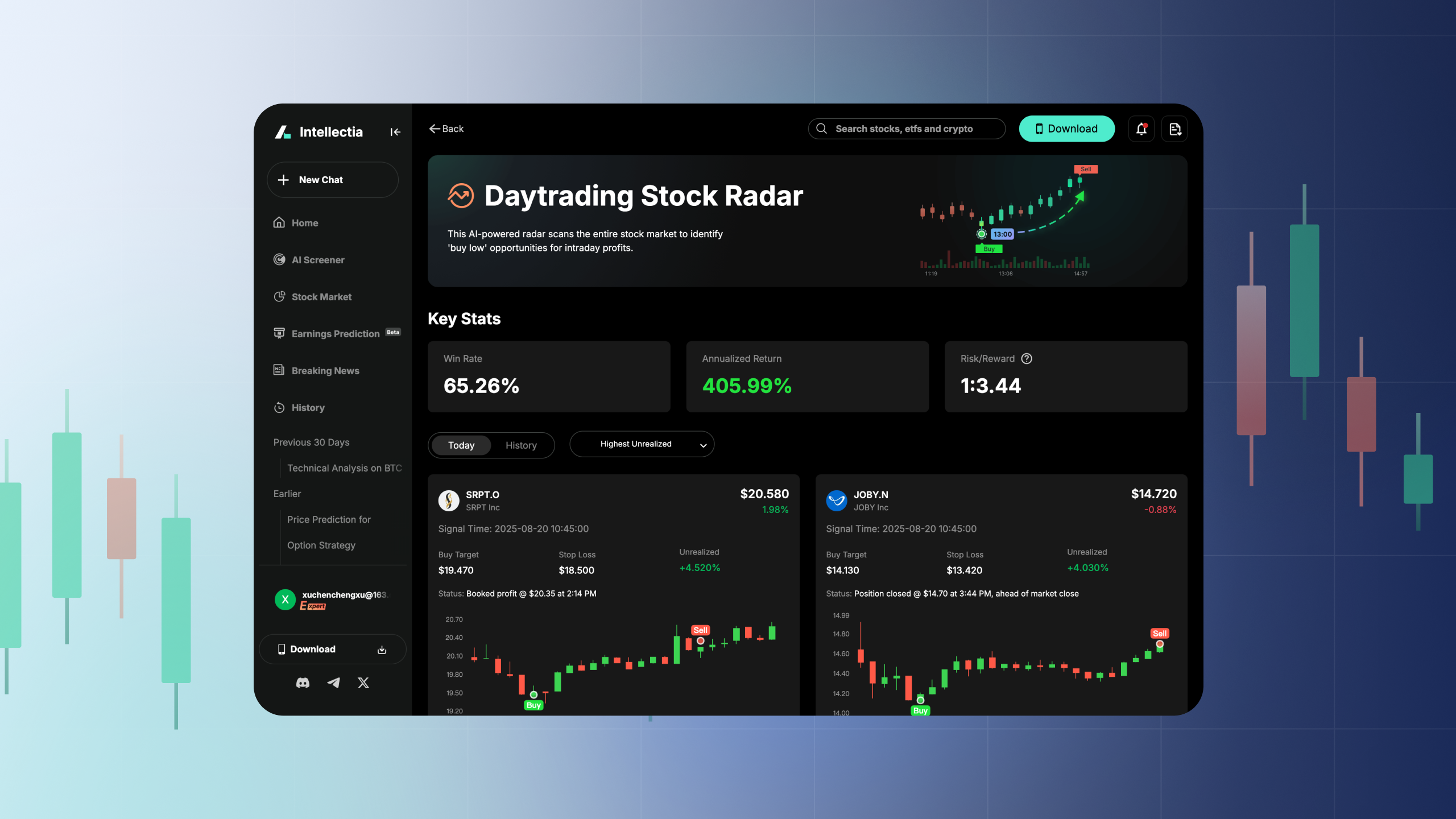

8. Intellectia.ai

Intellectia focuses on signal breadth, scanning events and scanning 500-plus AI-generated signals to surface daily trade ideas, including crossover insights from hedge fund activity.

Who It Fits

Traders seeking curated, event-driven signals and natural language querying for rapid idea generation.

Distinct Strengths

Voice-driven queries, cross-asset insights, and a tilt toward short-term and swing trade selection.

Tradeoffs and Notes

Signal volume is high; you need clear filters and stop logic to translate signals into disciplined execution.

9. Coinrule

Coinrule offers template-based rule creation, allowing traders to set triggers and actions without writing code and push orders to major exchanges.

Who It Fits

Beginners who want safe templates and limited live rules while they learn automation mechanics.

Distinct Strengths

Beginner-friendly templates, a conservative free tier with limited live rules, and support for popular exchanges.

Tradeoffs and Notes

The free plan limits live activity, so scaling strategies require upgrading or spreading rules across platforms.

10. Tickeron

Tickeron supplies diverse AI agents, ranging from signal agents to virtual agents, as well as brokerage agents that can replicate virtual executions in real accounts.

Who It Fits

Traders and investors who want a layered testing environment, where virtual performance can be replicated by brokerage agents when proven.

Distinct Strengths

One-minute delayed data for simulation realism, virtual-to-brokerage copy mechanisms, and portfolio construction tools for non-crypto assets as well.

Tradeoffs and Notes

Virtual agent performance can differ from live results once slippage and latency are introduced; treat brokerage copying as conditional, not guaranteed.

11. Pionex

Pionex bundles built-in, free automated bots, including grid, signal, and high-frequency market-making variants.

Who It Fits

Low-capital traders, because bots can be spun up with modest starting amounts, and users who want exchange-hosted bot convenience.

Distinct Strengths

Low barrier to entry, with many pre-built bots, such as Future Grids and Future Moon, available for arbitrage tasks, and security measures like withdrawal whitelists.

Tradeoffs and Notes

Exchange-hosted bots are easy, but they tie strategy and custody together; evaluate whether that tradeoff matches your risk tolerance.

12. Trade Ideas

What it does, in practice. Trade Ideas focuses on stock market AI with Holly AI, which analyzes momentum and backtests nightly to pick top candidates for the open. Who it fits. Traders who prefer AI-curated, real-time market scans and visual comparatives for rapid decision making.

Distinct Strengths

Nightly rule adaptation, real-time monitoring, and visual Picture-in-Picture charts for live comparison.

Tradeoffs and Notes

This platform is stock-centric; crypto traders seeking similar features must adapt signals and execution logic for different market microstructures.

Practical Adoption Signals

According to Coincub, over 70% of traders using AI bots report an improvement in trading efficiency. Many users see measurable workflow gains after shifting to bots, which explains why teams accelerate experiments. And at the execution layer, AI trading bots can execute trades 100 times faster than human traders. This speed difference is why execution architecture and order routing matter as much as strategy logic.

Operational Rule

That pattern raises a clear operational rule, not a slogan: pick a platform based on the weakest link you cannot tolerate, whether that is execution latency, custody model, signal quality, or ease of iteration, then validate with shadow execution before risking capital. That sounds like an ending, but the messy truth is something else entirely.

Related Reading

- Why Is Bitcoin Up

- Best AI Trading Bot

- Crypto Chart Patterns

- How High Can Bitcoin Go

- When Will Bitcoin Crash

- Bitcoin Fast Profit

Benefits of Using AI Bots for Crypto Trading

AI bots let you turn strategy ideas into repeatable outcomes: they scale testing, enforce rules across accounts, and free you to improve edge selection instead of firefighting execution or paperwork. When deployed responsibly, they raise the floor on operational reliability and let you focus on where your judgment still matters.

How Can Bots Compress the Research Loop and Cut Costs?

When you need to compare hundreds of parameter sets or stress a rule across different market regimes, bots let you run those experiments in parallel, overnight, instead of running them one at a time. That means you iterate from hypothesis to validated rule in hours, not weeks, while keeping exact versioned records of every test run. Think of it like a wind tunnel for trading rules, where every tweak produces a traceable output you can reproduce and audit.

How Do Bots Change Portfolio Risk Management?

Good automation treats rules as policy, not whim. Bots implement cross-asset exposure caps, waterfalled stop logic, and scheduled deleveraging automatically, so risk enforcement lives in code that anyone on the team can inspect. That reduces single-operator failure modes, standardizes position sizing across exchanges, and produces the granular logs that compliance teams need when regulators or counterparties request a clear audit trail.

What Prevents Human Error from Eating Gains?

Manual order entry and copy-paste workflows generate small mistakes that compound over time, especially across multiple exchanges and time zones.

According to CapTrader Blog, AI bots reduce trading errors by 70% compared to manual trading. Automated execution with built-in sanity checks and pre-trade validation catches those near-misses before they become losses, saving time and preventing avoidable drawdowns.

Centralizing Conversational Workflows

Most teams handle rollouts with spreadsheets, chat threads, and manual approvals because this process is familiar and feels low-friction. As rules grow and more stakeholders become involved, approvals become fragmented, context is lost, and deployment windows slip.

Platforms like AI crypto trading bot centralize strategy capture and approval, allowing teams to maintain their preferred conversational workflow while converting it into consistent, auditable deployments that scale.

Do Traders See Better Outcomes?

Reports from practitioners support the technical benefits with measurable outcomes. In 2025, CapTrader reported that 85% of crypto traders using AI bots experienced increased profitability. However, the data also highlighted an important caveat. These gains were achieved only when:

- Position sizing

- Liquidity assumptions

- Governance controls were managed correctly

In short, adoption can provide an edge—but disciplined deployment is what makes that edge reliably profitable.

What Mental and Workflow Relief Do Bots Provide?

Automation offloads repetitive, attention-intensive tasks, allowing you to focus on strategy selection, portfolio construction, and responding to unusual events. That shift reduces decision fatigue and preserves cognitive bandwidth for real judgment calls. Picture a precision instrument that keeps the mechanics steady, so you can concentrate on tuning the melody.

Plain English Strategy Deployment

CoincidenceAI transforms your trading ideas into live strategies using plain English. No coding or complexity, just describe what you want to trade, backtest it instantly on real data, and deploy it live to exchanges like Bybit and KuCoin; Built for traders who think in strategy, not syntax, Coincidence's AI crypto trading bot gives you the power of a professional quant desk in a tool anyone can master.

AI and the Future of Crypto Trading

AI will become the infrastructure layer under successful crypto trading, not a magic bullet. Models will accelerate iteration and guide execution along predictable paths; however, the human role will shift toward selecting ideas, overseeing governance, and managing risk.

How Will Models and Data Evolve Next?

Expect tighter partnerships between model teams and data providers, with an increased focus on on-chain signals, alternative data feeds, and federated learning to keep models current without centralizing all data. The trend is already measurable, as AI-driven trading algorithms have increased trading efficiency by 35% in the past year. The a16z State of Crypto report 2025 frames gains in operational efficiency as:

- Faster hypothesis tests

- Cleaner execution

- Lower per-trade overhead for teams that build disciplined pipelines

What Does That Mean for Finding a Real Edge?

This challenge is evident across retail and semi-professional traders: AI will surface hundreds of plausible signals, but the durable winners originate from an economic idea, not a pattern the model happens to like. It is exhausting when a system proposes a “perfect” pattern that unravels under live slippage or regime change.

From Prediction to Robust Execution

As more platforms embed intelligence, and as over 50% of crypto trading platforms now incorporate AI for predictive analytics, the competitive advantage moves away from raw signal discovery and toward:

- Experiment design

- Robust sizing rules

- Realistic execution assumptions

Most teams manage rollout by stitching together alerts, spreadsheets, and approval threads.That familiar approach works early, but as strategies multiply, context fragments, review cycles stall, and muted errors scale into overnight losses.

Compressing Deployment with AI Control

Platforms like CoincidenceAI replace fragmented workarounds with conversational strategy capture, automated safety gates, and exchange-native key handling, thereby compressing deployment windows while preserving auditable decision trails and exchange-side custody, ensuring funds remain where they belong.

How Should Governance and Deployment Change Now?

To achieve reproducible results at scale, consider implementing deployment gates that include shadow execution, slice-aware sizing, automatic fallback modes, and real-time drift alerts. These alerts can pause a model when its behavior deviates from historical patterns. Think of governance like a pit crew, not a single mechanic, where each role runs a checklist between laps:

- Model surveillance

- Pre-trade validation

- Rapid rollback

Those processes turn speculative signals into risk-managed automation that survives volatility.

Where Does Human Judgment Fit In?

As models automate routine work, your job is to craft cleaner hypotheses, identify failure modes to test, and design safety nets that prevent minor mistakes from escalating into major issues. This requires new habits, including scheduled parameter sweeps, cross-regime stress tests, and clearly versioned experiments that can be replayed if a live trade behaves oddly.

Treat AI bots for trading as precision tools that amplify your edge only when you set the frame and the limits. There is one detail that almost everyone underestimates, and it will decide who wins next.

Trade with Plain English with our AI Crypto Trading Bot

We see this pattern across retail and semi-pro traders: you want a real edge and a way to turn strategy ideas into live execution without learning to code. Consider CoincidenceAI, which converts plain-English strategy intent into exchange-connected bots with 24/7 trading capability and has driven an 85% increase in trading efficiency in 2025, so you can scale your edge securely while funds remain on your exchange.