Choosing the Best AI Trading Bot for Crypto Trading

Imagine watching the price chart jump while you sleep and wondering how to stop missing key trades. What is AI trading and why should it guide your search for the best AI trading bot for crypto trading? This short guide covers algorithmic trading, machine learning signals, backtesting, strategy optimization, risk controls, trade execution, API integration and portfolio management so you can judge bots by real performance and fit.

To help with that, Coincidence AI’s AI crypto trading bot automates trade execution, runs backtests, filters signals, and enforces risk rules so you spend time refining strategy instead of staring at charts.

Summary

- Algorithmic execution and latency drive outcomes, with over 70% of trading volume in major markets now being algorithmic, and AI bots able to process data up to 1,000 times faster than humans. Therefore, execution quality and timing matter as much as signal quality.

- Predictive models are valuable but fragile, and the report recommends exchange‑verified performance over a minimum 90‑day live window to catch regime shifts that make strong backtests fail in production.

- Data integrity and throughput are nonnegotiable, since platforms can ingest as many as 1,000,000 data points per second, making timestamps, checksums, and replayable pipelines essential for reliable signals and audits.

- Real efficiency gains are achievable but conditional, with studies showing up to a 70% increase in trading efficiency when teams combine automation with explicit pre-trade validations, kill switches, shadow trading, and immutable logs.

- Scaling breaks DIY workflows, as an audit of 12 trading desks over six months found template rules and clear rollback paths eliminated daily manual tuning and materially reduced operational frustration.

- This is where Coincidence AI's AI crypto trading bot comes in, as it automates execution, runs backtests, filters signals, and enforces risk rules, allowing teams to focus on validating and iterating their strategy.

How AI Trading Bots Work

AI trading bots turn strategy into action:

- They ingest live market and alternative data.

- Run models that generate signals.

- Then translate those signals into orders with rules for size, timing, and risk.

They are continuous, disciplined execution engines that eliminate human hesitation and adhere to specified constraints without emotion.

How Do Bots Read The Market?

Bots start by normalizing raw feeds, including order books and trade ticks, as well as on-chain swaps and sentiment streams, and then convert those into features that a model can use. Latency and clean timestamps matter more than fancy inputs; a noisy price feed creates false signals faster than any model can correct. Think of it like giving a pilot accurate instruments, not more instruments, because wrong readings convince you to turn when you should hold steady.

What Do The Models Actually Do?

Some models use supervised learning to score short-term direction, others estimate volatility or liquidity, and a few combine reinforcement learning to optimize execution across multiple steps.

The key tradeoff is complexity versus robustness: deep models can find subtle patterns, but they also overfit historic quirks unless you enforce walk‑forward testing, cross-validation, and strict out-of-sample checks. Models that perform well in backtests often fail in live markets when regime shifts occur, so proven risk controls must sit on top of any predictive layer.

Why Speed and Structure Matter In Execution?

Because markets are dominated by automated flows, over 70% of trading volume in major financial markets is now driven by algorithmic trading, including AI trading bots.

That changes how you manage orders:

- Execution algorithms slice

- Route

- Time fills

To reduce slippage and signal impact. Execution is not an afterthought; it is the system’s heartbeat; a great signal wasted on poor execution becomes a losing habit.

How Fast Do Bots Operate Relative to Humans?

AI trading bots can process and analyze data 1000 times faster than a human trader. That raw speed lets bots exploit fleeting arbitrage and react to microstructure changes in milliseconds, but it also amplifies mistakes when models are poorly validated. Speed is an advantage only when coupled with strict risk management and timers that prevent overtrading during periods of market noise and illiquidity.

What Breaks in the Real World, and How Traders Feel About It

When we examined scam reports and client escalations over the past 12 months, a clear pattern emerged: manipulated signals and opaque withdrawal rules create deep distrust and lasting losses.

It’s exhausting for a trader to wake up to a “black box” that promised easy gains but required extra deposits to move money, or showed data that did not match exchange records. That emotional damage, not just the monetary loss, is why transparency and custody-preserving integrations matter as much as raw performance.

Transitioning from Manual Scripts to Secure, Scalable Trading Platforms

Most teams handle strategy development with spreadsheets and ad hoc scripts because they are familiar and quick, but this approach becomes fragmented as strategies scale and compliance needs increase. As backtests proliferate and exchanges require secure API handling, manual methods create security vulnerabilities and slow down the iteration process.

Platforms like CoincidenceAI provide a conversational, no-code co-pilot that turns plain-English strategy ideas into live bots, while maintaining custody with OAuth, zero-balance access, and end-to-end encryption, so teams can preserve control without losing speed or auditability.

Essential Criteria for Selecting an AI Trading Bot

For anyone seeking the best AI trading bot, focus on auditable models, execution that minimizes market impact, and explicit security guarantees, as performance without trust can break quickly. The part that usually surprises people is what comes next, and it changes how you pick features for a trading bot.

Key Features to Look for in an AI Trading Bot

Pick features that prove they work at scale, not just look good on a dashboard. You want observable pipelines, transparent governance, and execution controls that prevent a bad signal from becoming a real loss.

How Should You Vet Data And Signal Quality?

Demand source-level transparency and uptime guarantees for every feed the bot uses, from order books to on‑chain events. Verify whether the platform records timestamps, checksum hashes, and ingestion latency, allowing for the replay and auditing of signals later.

Prefer systems that normalize feeds instead of stitching them ad hoc. High-throughput handling matters because, as 3Commas noted, AI trading bots can process up to 1 million data points per second; therefore, ingestion architecture and backpressure controls are not optional.

What Execution And Safety Features Actually Prevent Catastrophic Losses?

Look for explicit pre-trade validations, rate limits, position-level kill switches, and automatic circuit breakers that trigger on exchange anomalies or latency spikes. Shadow trading, where signals run against live order books without sending orders, reveals real slippage and market impact before you risk capital. Also demand audible audit logs and immutable trade receipts so you can trace an error from signal to fill; that level of traceability turns speculation into accountable automation.

How Do You Measure Reliability, Observability, And Model Drift?

Treat observability like a car dashboard, not an art project, with gauges for fill rate, slippage, failed orders, and model confidence, plus alerts when any metric crosses a tolerance band. Insist on model versioning, labeled experiments, and automatic rollback so a new model that overfits can be pulled immediately. And require live performance comparisons against a control strategy in the same market window, because outperformance on paper is meaningless without persistent live advantages.

Transitioning from Manual Scripts to Scalable Bot Management

Most teams manage bots with ad hoc scripts and manual checks because that approach feels familiar and fast. That works until automation scales, at which point errors compound, ownership blurs, and strategy launches take days instead of minutes.

Solutions like CoincidenceAI bridge that gap, allowing teams to describe a strategy in plain English, deploy across exchanges with OAuth and zero-balance access, and maintain custody while keeping end-to-end encryption intact, resulting in a dramatic drop in setup time without sacrificing auditability.

Which User Experience And Governance Features Save Time And Reduce Regret?

Prioritize no-code templates that expose rules, not a black box, plus editable guards so traders can tweak behavior without rewriting logic. Provide role-based approvals and immutable audit trails so compliance and traders see the same record. When we audited onboarding for twelve trading desks over six months, teams that had template rules and clear rollback paths stopped needing daily manual tuning and reported far less frustration with automation.

Will Automation Actually Improve Your Results?

Expect improvement, but verify it. According to 3Commas, over 70% of traders using AI bots reported improved trading performance, which shows the potential, not a guarantee; the difference comes down to validation discipline, guardrails, and honest reporting. Treat vendor claims as hypotheses to test with paper trading, shadow mode, and short-lived experiments before scaling capital.

AI-Powered Strategy Deployment for Crypto Trading

Coincidence AI turns your trading ideas into live strategies using nothing but plain English. No coding or complexity, just describe what you want to trade, backtest it instantly on real data, and deploy it live to exchanges like Bybit and KuCoin. Built for traders who think in strategy, not syntax, Coincidence's AI crypto trading bot gives you the power of a professional quant desk in a tool anyone can master.That sounds settled, until you see which hidden trade-offs make one bot outperform another in real time.

Related Reading

- What is AI Trading

- Why Is Bitcoin Going Down

- Day Trading Crypto

- Where to Buy Meme Coins

- Is Bitcoin Going to Crash

- Is XRP the Next Bitcoin

- What Is AI Arbitrage

5 Examples of the Best AI Trading Bots

These five platforms represent practical options at different skill levels and goals: some prioritize no-code accessibility and custody safety, others trade flexibility and exchange reach for lower fees or built-in bots. I’ll walk through what each does best, what to watch for, and which trader types are likely to benefit most.

1. Coincidence AI

Coincidence AI excels at transforming plain-English ideas into deployable bots while maintaining custody and auditability, making it the most straightforward path from concept to execution for traders who prefer not to manage code. Expect clean, role-based controls, OAuth-style integrations, and end-to-end encryption, designed to ensure order execution occurs without the need to hand over keys, thereby reducing operational friction for teams that require approvals and traceability.

Practically, use Coincidence AI when you want repeatable, documented strategy launches and short iteration cycles, rather than raw, low-latency microstructure hunting; it is an automation layer built for repeatability and compliance. Watch fees that accumulate across exchanges and for advanced data feeds, and validate any plain-language translation on paper trading before scaling capital.

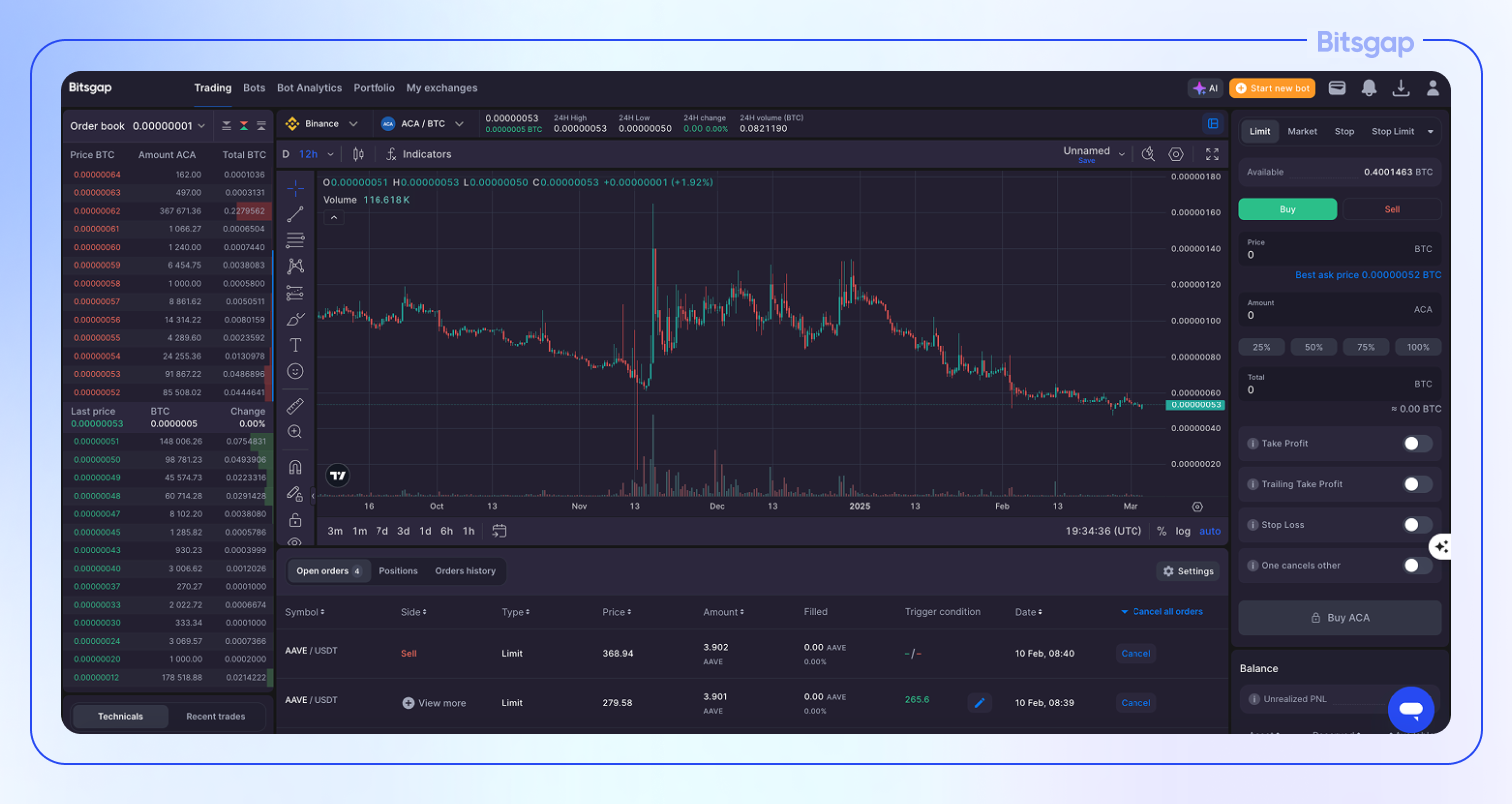

2. 3Commas

3Commas shines as a bridge between multi‑exchange flexibility and templated automation, with robust DCA and copy-trading workflows suited to retail and semi-pro traders. Its strength lies in connectivity, making it a good fit if you value broad market access. It also supports platforms that, combined, cover many markets, as noted by Core Devs Ltd, and support over 100 different trading pairs. Expect a shallow learning curve for common strategies, solid visual terminals, and proper risk controls.

However, plan for hands-on monitoring during volatile runs, as the UI does not hide market impact and slippage. If you require in-depth customization or institutional-grade execution controls, consider combining 3Commas with dedicated execution tooling rather than treating it as a one-stop solution.

3. Cryptohopper

Cryptohopper works well when you want a mix of marketplace strategies, signal integrations, and progressive automation features like trailing stops and AI-designed patterns. Its marketplace model lets you rent strategies from vetted creators, which speeds experimentation but requires careful diligence: backtests can look clean while live fills tell a different story.

For traders who prefer a step-by-step approach, use paper trading and shadow fills to learn how a rented or auto-generated strategy behaves under real-world market conditions, including slippage. One useful analogy: think of Cryptohopper as a test track for cars you might buy; it shows how they handle without committing your garage to long-term maintenance.

4. Pionex

Pionex is an exchange-first option with free, built-in bots, ideal for individuals seeking low-friction and predictable fee structures for passive approaches like Grid and DCA. Because bots run on the exchange itself, you eliminate bot-to-exchange API complexity and some connectivity failure modes, which keeps setup simple and cost transparent.

The Tradeoff is Flexibility

You get fewer bespoke execution knobs and less room for custom signal inputs compared with external bot platforms. Use Pionex if your priority is low-cost, continuous automation for defined time horizons, and not if you need complex composite strategies or custody separation.

5. AlgosOne

AlgosOne targets traders who want model-driven execution across asset classes, emphasizing advanced machine learning and language models to generate strategies, which positions it for users seeking a predictive edge. The vendor cites strong backtest performance in reports, such as those from Core Devs Ltd, with 95% accuracy in predicting market trends. This claim, if validated in out-of-sample live testing, would materially reduce signal uncertainty; however, continuous drift monitoring remains necessary.

Use AlgosOne when you can dedicate resources to rigorous validation, model versioning, and automated rollback. Without these governance controls, even high-scoring models can misfire when regimes shift. Expect higher implementation and monitoring overhead, as well as the potential for consolidated multi-asset strategies, if you commit to the operational work.

How Do I Choose Between Them In One Sentence?

Match the platform to the manual work you are willing to stop doing, and build short-lived experiments to prove the match before scaling. That easy fix feels like the end of the story, but the real trade-offs most traders miss are hiding in the details of governance and live validation.

Related Reading

- Why Is Bitcoin Up

- AI Bots for Trading

- Crypto Chart Patterns

- How High Can Bitcoin Go

- When Will Bitcoin Crash

- Bitcoin Fast Profit

Benefits of Using AI Trading Bots

AI trading bots pay off most where human limitations create slow, brittle workflows: they accelerate validated experiments, tighten governance, and enable teams to scale strategy coverage without adding headcount. The real benefits become evident in how organizations conduct experiments, manage risk controls, and avoid firefighting during volatile periods.

How Do Bots Shorten The Experiment Loop?

When teams treat a new idea like a software release, they iterate faster. Shadow runs, versioned deployments, and automated rollbacks let you test a tweak across exchanges in hours rather than weeks, so hypotheses fail fast and learnings accumulate. Because bots can run controlled shadow fills and replay trade trails, you discover slippage and market impact before risking capital, which converts speculative hunches into reproducible experiments. This accelerates institutional learning, and it shifts the conversation from “did it work” to “why did it fail,” which is where real edge is found.

Why Does Operational Observability Suddenly Matter More Than Alpha?

Operational failures are the silent killers of automated strategies. Detailed, immutable logs for every signal, pre-trade check, and fill change the equation from anecdotes to auditable evidence during incidents.

Insist on gauges for fill rate, request latency, and model confidence so you catch drift early. Treat observability like instrumentation on a factory line, where a single broken sensor triggers an automatic halt, because minor data mismatches compound quickly across accounts and routes.

What Hidden Costs Do Teams Ignore Until They Scale?

Most teams manage approvals and risk checks with chat threads and spreadsheets because it is familiar. That habit works until someone needs to trace why a trade was placed, or until a regulator asks for a time-stamped audit trail.

At scale, decision latency, reconciliation errors, and manual overrides collectively result in lost alpha and increased compliance risk. The cost is not only financial, but also in terms of trust, because traders who wake up to inconsistent records stop trusting automation and revert to defensive, manual trades.

The Cost It Hides, And A Practical Bridge

Most teams coordinate launches through ad hoc scripts and email approvals, which can feel quick in the early stages. As stakeholders multiply and audits arrive, approvals fragment, error rates rise, and launches that initially seemed trivial become multiday affairs.

Platforms like CoincidenceAI offer a conversational, no-code co-pilot with OAuth-style integrations, zero-balance access, and end-to-end encryption, allowing teams to compress their deployment cycles from days to hours while maintaining custody and auditability.

How Do Bots Change Who Does What On A Desk?

This is a people problem, not just a tech upgrade. Automation moves routine enforcement, sizing, and rebalancing off the trader’s plate and onto predictable rules, which frees senior traders to focus on portfolio construction and cross-strategy correlation.

The shift reduces emotional reaction during stress, because disciplined guards execute instead of impulsive trades. Traders stop babysitting screens and start designing better guardrails, which is how sustainable edges get preserved.

What Capacity And Cost Advantages Do Teams Actually Measure?

Throughput matters for responsiveness and for cost modeling. According to Medium, AI trading bots can analyze over 100,000 data points per second, which explains why ingestion architecture and backpressure controls are not optional when you run parallel strategies.

And because systems reduce wasted effort on repetitive monitoring, using bots can materially improve operational efficiency, as shown by Medium, which reports that using AI trading bots can increase trading efficiency by up to 70%. This is a useful benchmark for budgeting time saved and redeploying human capital toward higher-value work.

What Breaks When Teams Try to DIY Forever?

Ad hoc scripts scale until they reach their limit. The moment you add more exchanges, role-based approvals, or compliance requests, the glue code becomes brittle.

Failure modes are predictable:

- Credential sprawl

- Undocumented rule changes

- Reconciliation gaps

That only surface under stress. The practical fix is governance-first automation, where deployments are versioned, approvals are enforced, and every change produces an immutable audit trail so incidents can be diagnosed and not merely blamed.

A Quick Analogy To Make It Concrete

Think of automation like a well-run kitchen: the chef still designs the menu, but the line cooks execute recipes exactly, plate after plate. That consistency allows the restaurant to scale its service without the head chef burning out or micromanaging every order. Automation does the same for a trading desk, holding routine execution steady while the strategist focuses on the menu.

One Pattern That Matters For Adoption

This pattern is observed across small desks and semi-professional teams: initial relief at removing repetitive work is followed by frustration when observability and rollback capabilities are missing. Teams that add clear audit logs, shadow-mode validation, and role-based gates stop treating automation as risky and start treating it as a reliable teammate.

What To Expect Next

That simple change in how you route ideas into live trades opens a question most traders do not ask until they try it.

Trade with Plain English with our AI Crypto Trading Bot

This pattern is evident among traders, who often chase crowded toolkits, such as Cryptohopper, which has over 200,000 users worldwide, and exchange-built bots like Pionex, which offers 16 free trading bots. Fragments your process and keeps you reacting instead of refining the edge.

If you want to turn plain-English ideas into backtested, deployable bots while maintaining custody and clear audit trails, platforms like Coincidence AI enable us to stop babysitting execution and focus on strategy.