19 Top AI Crypto Trading Bots on the Market and How to Choose

You watch the crypto tickers swing at odd hours and wonder if you should act or wait. What is AI trading? It utilizes machine learning, neural networks, and algorithmic trading to analyze market data, generate trading signals, execute trades across cryptocurrency exchanges, backtest strategie,s and help manage portfolio risk and volatility. This article walks you through the top AI crypto trading bots on the market and shows how to choose one that fits your goals, from strategy optimization and indicators to execution and risk management.

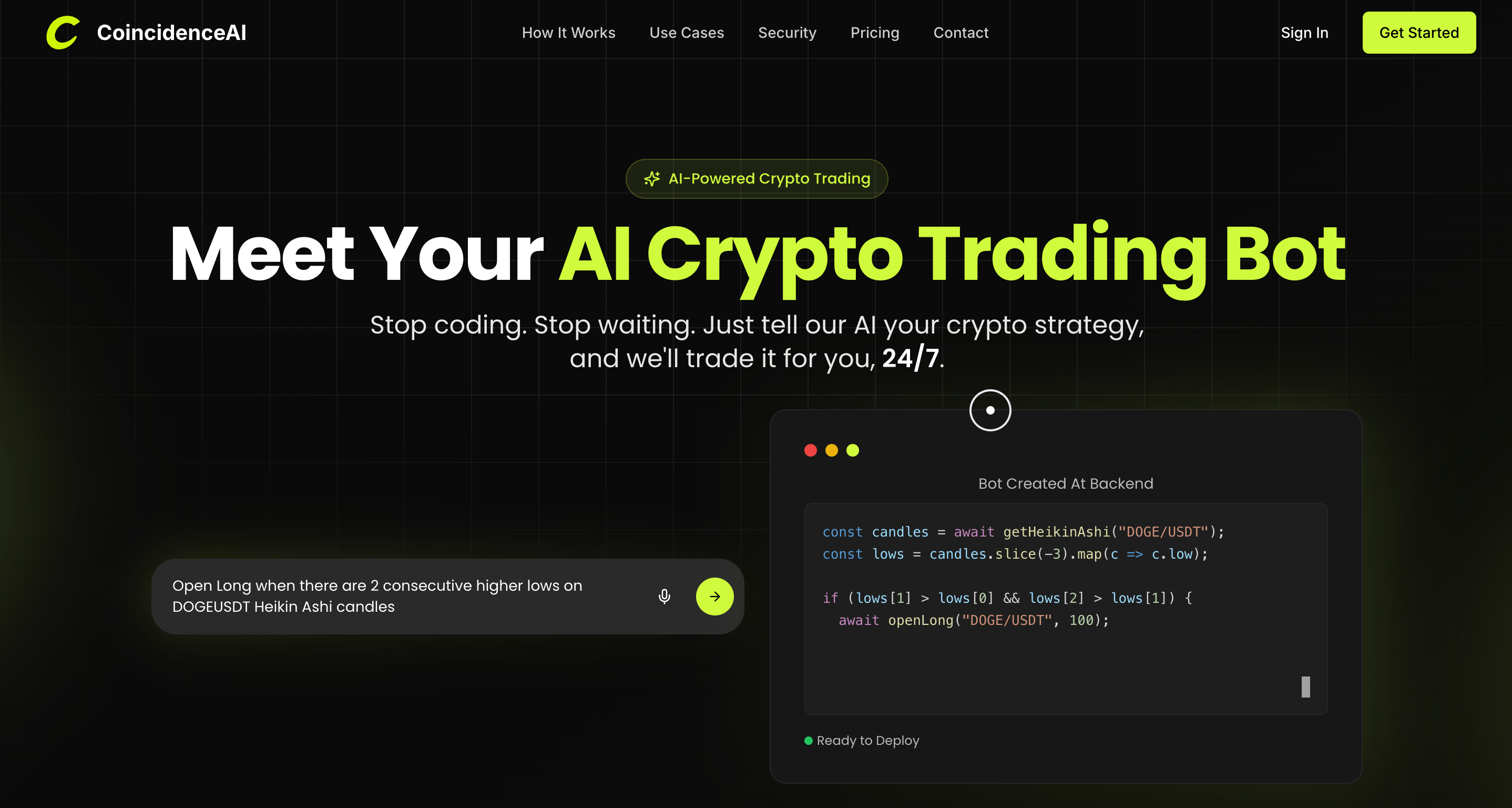

To help you pick, Coincidence AI offers an AI crypto trading bot that lays out bot performance, backtesting results, and simple risk settings so you can compare options and spend less time watching charts.

Summary

- Automation now dominates crypto execution, with over 70% of trading volume driven by bots and more than 70% of traders using AI trading bots, making automation a primary market force.

- AI-driven systems significantly enhance execution and risk control, with algorithmic trading increasing efficiency by up to 70% and users reporting a roughly 50% reduction in trading errors.

- Manual scaling breaks quickly, as credential sprawl and fragmented scripts turn what starts as fast prototype work into lengthy engineering cycles, while platforms can compress deployment time from days to minutes.

- Operational metrics are critical to trust, so monitor concrete numbers such as the order rejection rate, median and 95th percentile latency, and fills at the quoted size. Investigate if order rejections exceed 1% within a 24-hour window.

- Speed and continuous availability alter the opportunity set, as AI systems can execute trades up to 1000 times faster than human traders, and running 24/7 can increase actionable setups by approximately 30%.

- Demand reproducible validation and staged rollouts, for example, Monte Carlo stress tests, A/B deployments at 0.5x versus 1x capital, and a 30-day blind trial to verify fills, slippage, and drawdown versus vendor claims.

- This is where Coincidence AI's AI crypto trading bot comes in; it translates plain-English strategy descriptions into backtested, non-custodial bots while enforcing scoped API access and explicit risk limits, allowing teams to compress deployment time from days to minutes.

What are AI Crypto Trading Bots?

AI crypto trading bots are execution engines that turn a trader’s rules and signals into continuous market action, running on exchange APIs while enforcing explicit risk limits. They do more than fire orders; the best of them monitor markets, adapt models, and keep trades repeatable and auditable without handing over custody of your funds.

How Are AI Bots Different from Older Rule-Based Systems?

Older bots follow fixed if-then rules, which remain effective until the market structure changes or an edge becomes obsolete. Modern AI-driven bots layer statistical learning on top of regulations, allowing a strategy to generalize from patterns, weigh news or sentiment signals, and adjust position sizing dynamically as uncertainty changes.

Think of the difference as a thermostat that reacts to a fixed schedule versus one that learns how your house cools and prevents overshoot on hot afternoons.

What Do Traders Struggle with When They Adopt Automation?

After working with traders who attempt to use automation, a clear pattern emerges: many platforms promise effortless profits but deliver complexity, or they lock users into custodial workflows that feel risky. That frustration is real and costly—users abandon setups when onboarding takes too many steps or when a bot’s behavior becomes opaque.

When traders find a system that strikes a balance between ease and measurable controls, satisfaction quickly replaces doubt.

Why Trust Automation Instead of Manual Oversight?

Automation reduces human fatigue and enforces discipline. For a market already dominated by machines, this matters practically. According to findings on automated trading volume, automated execution now shapes a significant share of price movement. Likewise, data on AI bot profitability indicates that many traders see improved outcomes when automation is used thoughtfully and monitored.

What Breaks When Teams Try to Scale Strategies Manually?

Most teams build strategies manually because it feels familiar and gives them control, and that works at a small scale. As the number of markets, exchanges, and risk constraints increases, manual scripts and spreadsheets become fragmented, errors creep in, and deployment times balloon. The hidden cost is not just time lost; it is inconsistency: profitable rules that work in one market fail in another because human tuning cannot keep up with 24/7 volatility.

How Do Platforms Change That Tradeoff?

Platforms like CoincidenceAI enable teams to convert plain-English strategy descriptions into tested, deployable bots, while keeping funds non-custodial on the exchange, thereby preserving control and auditability. This path reduces deployment time from days of engineering to minutes of configuration, and it embeds safety features such as limited-scope API access, position sizing, daily loss caps, circuit breakers, and paper trading so automation scales without blind trust.

A Short Analogy to Make It Concrete

Treat an AI bot like autopilot for a small plane: you do not hand over responsibility and walk away; you set clear limits, verify the route in a simulator, and let the system handle the repetitive, high-frequency work while you focus on strategy and risk. That solution feels promising, but the next question is unavoidable and sharper than most expect.

Related Reading

- What is AI Trading

- Why Is Bitcoin Going Down

- Day Trading Crypto

- Where to Buy Meme Coins

- Is Bitcoin Going to Crash

- Is XRP the Next Bitcoin

- What Is AI Arbitrage

Key Features of AI Crypto Trading Bots

The key features to look for are practical, testable controls plus an interface that matches how humans actually think and trade. In practice, this means clear security and permissioning, deterministic risk controls and scenario testing, fast yet auditable deployment paths, transparent pricing and support, and reputational signals that can be verified quickly.

User-Friendly and Intuitive Design

After working with traders over several months, the pattern became clear: onboarding friction is the single biggest reason good strategies never reach automation. Expect plain-English strategy inputs, progressive disclosure of advanced settings, and one-click paper-to-live flows so you can iterate without getting lost in toggles.

Design Choices Matter

Contextual tooltips appear only when a user changes leverage, for example, to cut configuration errors. Template strategies with editable guardrails let experienced traders customize without rebuilding.

Security

Security should be engineered as a feature, not an afterthought. Look for least-privilege API keys, automatic key rotation, audit logs that record every simulated and live order, and external security audits with published findings. When trading volume is concentrated in automated systems, the attack surface grows, which is why projections about AI-driven trading volume are relevant—they highlight why hardened permissioning and transparent audits are crucial in operational terms.

Risk Management and Stress Testing

Adequate risk controls extend beyond single-stop orders. Expect correlation‑aware position limits, dynamic sizing based on recent realized volatility, automated daily loss caps, and programmable circuit breakers that halt activity when market microstructure breaks down.

Also, demand scenario testing includes Monte Carlo or bootstrapped backtests that reveal tail outcomes, as well as forced paper-trading windows that replicate execution latency and slippage. Think of these safeguards like automotive crash tests; they do not improve driving skill, but they tell you how the system behaves under stress.

Transparent Fee Structure and Reliable Customer Support

A bot can be excellent and still cost you more than expected if fees are hidden. Transparent platforms publish exact trading, subscription, and performance-fee calculations, along with examples that illustrate how fees change across varying trade frequencies and market spreads.

On the support side, vendors should offer SLA targets, escalation paths, and accessible raw logs, so you and your auditor can quickly trace an incident. Traders value speed here; a 24-hour outage response that turns into a week of silence erodes trust faster than any feature gap.

Social Presence, Reputation, and Verifiable Claims

Reputation is a signal, not noise. Favor bots with verifiable track records, public changelogs, third-party performance attestations, and active security disclosures. Community endorsements matter when they are specific:

- Evidence of users praising simple interfaces

- Dependable automation

- Responsive support is stronger than vague marketing.

Improved Portfolio Performance with AI Bots

Because many traders are turning to adaptive automation, the finding that over 60% of users report improved portfolio performance with AI bots provides valuable context. It points to measurable upside, but it also underscores the need to examine factors such as sample selection and the timeframes behind these results.

Status Quo Disruption: The Deployment and Scale Problem

Most teams start by scripting strategies and wiring APIs because it gives them a sense of control. That familiar approach works until markets, exchanges, and constraints multiply, at which:

- Point scripts fragment

- Credentials leak

- Deployment becomes error-prone

Configuration Over-Engineering

Teams find that platforms such as CoincidenceAI compress that friction by translating plain-English rules into tested, one-click deployable bots with scoped API access and built-in testing, cutting iteration time from days of engineering to minutes of configuration while keeping custody on the exchange.

Failure Modes and What to Watch For

The common failures are not exotic. Overfit backtests that ignore latency, complex UIs that hide critical guardrails, and support teams that cannot produce raw logs when things go wrong.

Demand Reproducibility

You should be able to run the same strategy in paper mode, change one variable, and see predictable differences in outcomes. If a platform cannot reproduce a prior run with the same seed data, treat that as a red flag.

A Short, Unavoidable Question to Keep in Mind

Which of these features actually moves the needle for your strategy, and which are noise you can skip? That simple question is where most traders get stuck—and it makes the next part of this guide essential.

19 Top AI Crypto Trading Bots on the Market

1. Coincidence AI

CoincidenceAI turns plain-English strategy descriptions into backtested, deployable bots without requiring code. It compiles your prompt into a structured strategy, runs historical validation, and readies one-click deployment to major exchanges via scoped API/OAuth. Expect fast iteration, built-in paper trading, and explicit risk controls, such as position sizing and daily loss limits, that you can set before going live.

Best for: Traders who think in terms of ideas rather than scripts and want reproducible, auditable deployments with non-custodial execution.

2. Cryptohopper

Cryptohopper remains a strong choice for beginners because it bundles copy trading, grid setups, and a marketplace of pre-built trading strategies. It integrates with over 17 exchanges and offers a freemium tier, along with paid plans for additional bots and signals. The platform’s marketplace accelerates idea testing, though power users sometimes find customization limits when they need low-latency or exotic order types.

Best for: Newcomers who want templates, social signals, and an easy on-ramp to automated execution.

3. 3Commas

Traders choose 3Commas when they need a balanced mix of smart trading terminals, DCA, and grid bots, and a unified portfolio view across exchanges. It supports over 16 exchanges and offers tiered plans ranging from $0 to $59/month, with smart stop-loss and take-profit chaining that reduce manual oversight.

Good for: Managers who run multiple strategies simultaneously and want consolidated reporting without building tooling from scratch.

4. Pionex (Built-in Exchange Bots)

Confident stance: Pionex packages 16 free built-in bots directly on its exchange, removing the need for external API keys. The model is simple: trade inside the exchange ecosystem with a 0.05% fee and let cloud-hosted bots run continuously. That locked-in convenience lowers setup friction, but traders who require cross-exchange arbitrage or bespoke integrations will feel constrained.

Best for: Cost-sensitive users seeking hands-off automation within a single platform.

5. Coinrule

Coinrule targets non-technical users with a rules-based, drag-and-drop builder and over 250 logic combinations. It connects to major exchanges and scales from a free tier to enterprise-level pricing based on complexity and volume. The interface is deliberate: you build readable rules, simulate them, and then deploy, which speeds cognitive load for strategy design while sacrificing some low-latency control.

Best for: Traders who want visual logic without coding.

6. Dash2Trade

Dash2Trade emphasizes sentiment analytics and predictive signals, blending news and on-chain signals with classic bot templates, such as DCA and grid. Users report strong performance in trending markets but choppier results in range-bound periods. Pricing falls within the $20–$50/month range, with trials available. Consider it if you want an analytics-driven feed that drives execution rather than pure technical-rule automation.

7. Bitsgap

Bitsgap is geared toward cross-exchange traders who need arbitrage routing, automated rebalancing, and multi-bot orchestration. It links 15+ exchanges and includes robust backtesting and paper-trading modes. Complexity rises with capability. Configuring multi-exchange pathways and reconciling fills takes time, but the payoff is centralized control over diverse venues.

Best for: Intermediate traders managing portfolios across several exchanges.

8. WunderTrading

WunderTrading combines arbitrage and mean-reversion tools with social trading features, allowing you to follow strategy authors and replicate their setups. Integration supports over 10 exchanges, and the platform scales from free to modest premium tiers.

Quantitative analysts appreciate the statistical framing, although beginners may need support to interpret signal metrics. Best for traders focused on arbitrage or quantitative tactics who also value community-sourced strategies.

9. TradeSanta

TradeSanta offers a clean, templated set of bots—grid, DCA, and long/short templates—so you can spin up automation quickly with minimal configuration. It supports major exchanges and offers a free tier with limited bot counts, while premium plans provide expanded concurrency and advanced parameters.

The tradeoff is between simplicity and nuance: it’s excellent for low-friction setups, but not for custom, correlation-aware sizing.

Best for: Straightforward, low-risk automation

Manual Fragmentation vs. AI Automation

Most teams handle strategy deployment by cobbling together scripts and spreadsheets because it’s familiar and fast to get started. As the number of markets and checks increases, these manual flows become fragmented, resulting in credential sprawl, inconsistent risk settings, and lengthy QA cycles.

Teams find that platforms like Coincidence AI compress that friction by translating human language into tested bots, with scoped API access and built-in testing that cuts configuration time from days to minutes while keeping custody on the exchange.

10. AlgosOne

AlgosOne promises risk-managed AI trading with deep-learning adaptation and claims high win rates for short-term tactical plays. It supports altcoins and meme tokens, utilizing a subscription model for approximately $59/month. The engine’s closed nature warrants skepticism: rely on thorough paper trading and sampling windows before scaling capital.

Best for: Traders willing to trust a black-box model after extended evaluation.

11. Octobot

Octobot is open-source and developer-first, delivering full Python scripting, CCXT compatibility, and plugin support for tools like TradingView. It runs locally or in the cloud and incurs no software fees, although you will need to pay for hosting if you require uptime guarantees. Ideal when you need absolute control over logic and latency, and can maintain your own infrastructure.

Best for: Developers who prefer building from the ground up

12. Stoic.ai

Stoic.ai, from Cindicator, automates long-term portfolio management using hedge-fund-style quantitative techniques, rebalancing large-cap crypto weights against volatility. It offers performance tracking through a mobile app and charges a flat management fee, making it suitable for passive investors who prefer hands-off exposure.

The product reduces active decision overhead but is not designed for intra-day trading or high-frequency strategies. Best for buy-and-hold investors seeking algorithmic rebalancing.

13. Quantum AI

Quantum AI positions itself on speed and advanced modeling, blending deep learning and speculative quantum concepts to claim ultra-fast trade selection. Its marketing sometimes outpaces verifiable details, and pricing models range from profit-sharing to deposit-based approaches.

Treat claims of actual quantum advantage with caution and insist on transparent execution logs and latency tests before committing significant capital. Best suited for speculative users who accept a higher risk of transparency.

14. Bit Index AI

Bit Index AI pairs sentiment-derived buy/sell signals with educational dashboards and simulation modes, making it a learning-first platform for newcomers. It supports major exchanges and provides a free demo for hands-on practice. The educational scaffolding helps traders understand signal drivers, rather than treating signals as magic.

Best for: Learners who want guided exposure to AI-driven signals and decision transparency.

15. Haasonline

Haasonline is for professionals who require deep scripting power and on-premise control, utilizing HaasScript to encode complex strategies, custom indicators, and advanced modules, such as flash-crash detection. It supports over 25 exchanges and focuses on privacy and advanced tooling at the cost of a steeper setup and a quarterly licensing model.

Best for: Institutional users or advanced traders who require fine-grained control and private execution.

16. Kryll.io

Kryll.io democratizes strategy creation with a visual drag-and-drop canvas, built-in backtesting, and a marketplace for strategy exchange using KRL token-based billing. It’s pay-as-you-go, which suits experimenters who want to iterate without long subscriptions. Because logic is visual, non-programmers can quickly prototype complex flows; however, token economics add an extra layer to cost calculations.

Best for: Experimenters and educators

17. Trade Ideas

Trade Ideas focuses on equities with an AI engine that runs overnight scenario selection and intraday scanning, powered by its Holly AI. While its primary market is stocks, its model demonstrates how precomputed, high-probability strategy selection can scale in crypto if appropriately adapted.

Traders who prioritize idea generation and probabilistic selection will recognize the utility of such engines when ported to crypto markets.

Best for: Traders seeking systematic idea curation that can inform cross-asset strategies.

18. TrendSpider

TrendSpider automates technical analysis tasks, scans for pattern-based setups, and provides automated alerts and backtesting utilities. The platform streamlines repetitive chart work and helps enforce discipline by converting manual pattern hunts into repeatable scans. It’s powerful when you want consistent signal generation from technical frameworks, though it does not replace execution infrastructure.

Best for: Analysts who want automation on the research side before plumbing strategies into execution.

19. Pionex (Exchange-Level Automation)

Constraint-based: Returning to Pionex with a slightly different angle, view it as a low-barrier exchange that embeds algorithmic orders at the matching engine level, rather than as a separate bot overlay. That means the exchange handles stability and uptime, but you trade within a single custody environment and accept their order-routing constraints.

Best for: Traders who prefer exchange-built automation and minimal third-party integration.

AI Adoption and Execution Speed in Crypto Trading

A quick note on adoption and speed—both critical when selecting tools: More than 70% of crypto traders now use AI trading bots to enhance their strategies. Execution velocity also matters, as some platforms report that AI systems can execute trades up to 1000 times faster than human traders, highlighting how automation reshapes opportunity windows.

That pattern of choice, tradeoff, and testing should guide which platform you try first — like choosing the right tool for a specific job rather than grabbing the shiniest hammer. The surprising part? What appears safe at first often reveals the fundamental constraint only after scaling.

Benefits of Using AI Crypto Trading Bots

AI crypto trading bots speed up execution and reduce mistakes so you can scale ideas instead of tasks. They raise execution quality, compress operational overhead, and let you treat strategy design as the scarce resource you protect and sharpen.

How Do Bots Improve Execution Quality?

Bots route orders, slice fills, and adapt order cadence to market microstructure, which lowers slippage and improves realized returns on short windows. That operational edge matters when spreads and latency swing, because better fills compound over many trades and turn small edges into measurable gains.

According to recent findings, algorithmic trading bots can increase trading efficiency by up to 70%, highlighting how automation materially enhances execution quality.

Can Automation Meaningfully Reduce Human Error?

Yes, and the effect is tangible. Rules encoded and enforced by software stop simple mistakes like incorrect size, forgotten stop orders, or mismatched symbols, which otherwise multiply as you trade more markets.

One industry report finds that traders using AI bots have seen a 50% reduction in trading errors. A shift of that magnitude reshapes a trader’s risk profile—not just their comfort level.What does faster iteration actually buy you?

Auditable Backtests for Controlled Experiments

Faster backtests and consistent, reproducible simulations enable you to compare ideas more effectively, rather than relying on memory. When strategy logic, dataset, and execution assumptions are auditable, you can run controlled experiments:

- Change one parameter

- Run the same seed

- Learn why results diverged

That reproducibility makes research cumulative. It turns anecdotal wins into replicable playbooks and keeps you from overfitting to lucky stretches.

Why Do Teams Shift from Ad Hoc Scripts to Managed Orchestration?

This pattern is observed across prop desks and solo traders: manual scripts are effective until concurrency and complexity increase. Once you try to run more than a handful of strategies at scale, credential sprawl, inconsistent risk rules, and conflicting execution timings produce hidden losses.

Platforms that centralize orchestration and logging eliminate that friction, allowing teams to deploy multiple complementary tactics while maintaining a single source of truth.

The Fragmentation of Ad Hoc Deployment

Most teams handle deployment with a patchwork of scripts and spreadsheets because that feels fast and under control, especially early on. As strategy counts, exchange connections, and approval gates increase, those ad hoc flows become fragmented, audits become expensive, and incidents take longer to trace.

Platforms like AI crypto trading bots offer centralized audit logs, templated risk controls, and reproducible pipelines, enabling teams to maintain control as they scale without relinquishing custody or compromising traceability.

How Do Bots Change Portfolio-Level Thinking?

Bots let you manage capital with correlation-aware rules and automated risk budgeting, not gut calls. You can program position sizing to respond to recent realized volatility, set cross-strategy exposure caps, and enforce daily loss limits automatically. That moves capital management from a memory task into an engineering problem where constraints and outcomes are visible and testable.

What’s the Human Payoff?

Less firefighting, clearer meetings, and fewer sleepless nights. When execution, sizing, and stop logic are encoded and auditable, traders stop babysitting and start iterating. Think of it like shifting from tending campfires one by one to running a monitored furnace line that reports every anomaly so you intervene only when a real problem appears.

Strategy Over Syntax

CoincidenceAI transforms your trading ideas into live strategies using plain English. No coding or complexity required. Simply describe what you want to trade, backtest it instantly on real data, and deploy it live to exchanges like Bybit and KuCoin. Built for traders who think in strategy, not syntax, Coincidence's AI crypto trading bot gives you the power of a professional quant desk in a tool anyone can master.That sounds settled, until you realize that choosing the right bot exposes tradeoffs that quietly eat away at your edge.

Related Reading

- Why Is Bitcoin Up

- Best AI Trading Bot

- AI Bots for Trading

- Crypto Chart Patterns

- How High Can Bitcoin Go

- When Will Bitcoin Crash

- Bitcoin Fast Profit

How to Choose the Best AI Crypto Trading Bots

Pick the bot that matches the problem you want to solve, not the one with the flashiest marketing. Focus first on the time horizon, execution needs, and how the vendor validates assumptions. Then, require staged ramps and clear operational metrics before moving capital.

What Trading Goal Should Drive Your Choice?

If you trade intraday or arbitrage, prioritize a bot and exchange combination that supports advanced order types, low-latency routing, and predictable fills; if you trade swing or portfolio rebalancing, favour:

- Robust risk-budgeting

- Correlation-aware sizing

- Cheap and reliable scheduling

Execution Transparency

Match order types to venue capabilities, check maker versus taker fee regimes, and insist the vendor documents typical fill rates and expected slippage for each strategy class. The practical test is simple: if the vendor cannot demonstrate how a live order appeared in the venue with timestamps and fills, that product will likely surprise you when the size increases.

How Do I Trust a Bot’s Backtests and Models?

Request reproducible validation, not just glossy charts. Demand out-of-sample walk-forward tests, seeded randomization so runs are repeatable, and transaction-cost-aware simulations that include latency and slippage. Better vendors publish Monte Carlo stress tests that report tail losses, time to recovery, and sensitivity to execution delays.

Treat a backtest without execution simulation like a map without a scale; it tells the direction but not the distance.

Which Operational Metrics Should I Monitor in Production?

Look past returns to hard telemetry: order rejection rate, median to 95th percentile latency, percentage of fills at quoted size, API error rates, and daily uptime. Set thresholds you will act on, for example, investigate if order rejections exceed 1% in a 24-hour window, or if 95th percentile latency doubles versus baseline. Those numbers tell you whether a strategy is behaving or merely lucking into a streak.Most teams handle deployment by wiring scripts and spreadsheets because it is familiar and fast. That approach works initially, but as strategy counts and exchanges grow, credentials proliferate, risk rules drift, and audits take hours instead of minutes.

Platforms such as CoincidenceAI offer a different approach, converting plain-English strategy descriptions into tested, one-click deployable bots while maintaining non-custodial funds, enforcing scoped API access, and reducing operational friction from days to minutes.

How Should I Stage Capital When I Move from Paper to Live?

Treat live rollout like flight testing: begin with taxi runs, then short hops before full flights. Start with paper trading across the same API surface, then run a micro-live allocation with rigid position sizing and daily loss limits during a pre-specified market window. Only scale after several consecutive, reproducible runs under varying volatility.

Use A/B deployments, where one variant runs at 0.5x capital and another at 1x, to separate execution effects from signal quality. If a platform cannot enforce these guardrails automatically, you are taking on unnecessary operational risk.

What Transparency and Support Should I Demand?

Insist on raw execution logs, change history for strategy code or prompt-to-strategy translations, and a clear SLA for incident response with access to audit artifacts. Independent security audits and public changelogs matter more than polished marketing language. Also, test support before you trust it: open a live ticket with a non-critical request and measure the response time and the quality of the logs provided.

Why Watch Execution Timing and Opportunity Windows Closely?

Because AI systems run continuously, they expand the range of trades you can capture. Evidence shows that 24/7 execution can increase trading opportunities by around 30%, meaning constant availability opens up more actionable setups—and your monitoring strategy needs to account for nights and weekends as well.

Structural Gains from Automation

Because automation compounds small advantages across many trades, you should verify that gains are structural, not a function of higher trade frequency; studies show that, when used properly, many traders see measurable uplift from automation, a practical signal that careful tool selection matters in real dollars and risk.

A Final Practical Litmus Test Before You Commit Capital

Run a thirty-day blind trial where the vendor provides full logs but withholds strategy labels, then compare realized fills, slippage, and drawdown durations to the vendor’s claims; if the numbers match within reasonable tolerances, the product is behaving as advertised, and you can scale with more confidence. If not, you just saved yourself a costly lesson.You think you know how this ends, but the way plain-English strategy translation actually works exposes a subtle gap most people miss.

Trade with Plain English with our AI Crypto Trading Bot

I understand the hesitation to automate—handing execution to software can feel irreversible when your edge matters, and that tension is common among active traders. With over 70% of crypto traders now using AI trading bots to enhance their strategies, and trading errors reduced by up to 90% compared to manual execution, platforms like CoincidenceAI can translate your plain-English rules into backtested, non-custodial bots with explicit risk limits, allowing you to iterate faster without surrendering control.

Related Reading

Humza Sami

CTO CoincidenceAI